Newpoint is a sham: Part 4

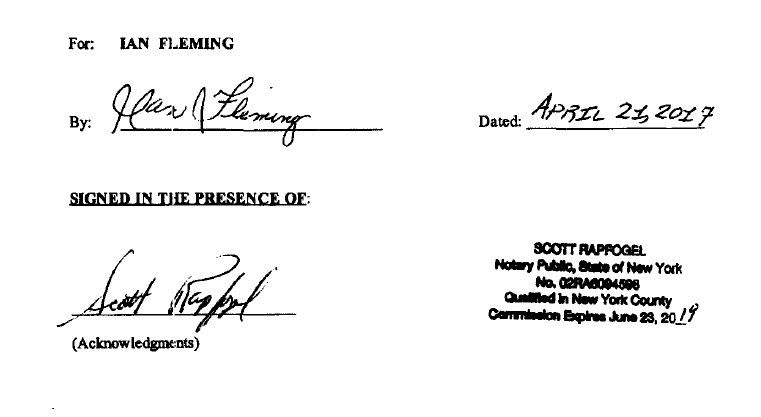

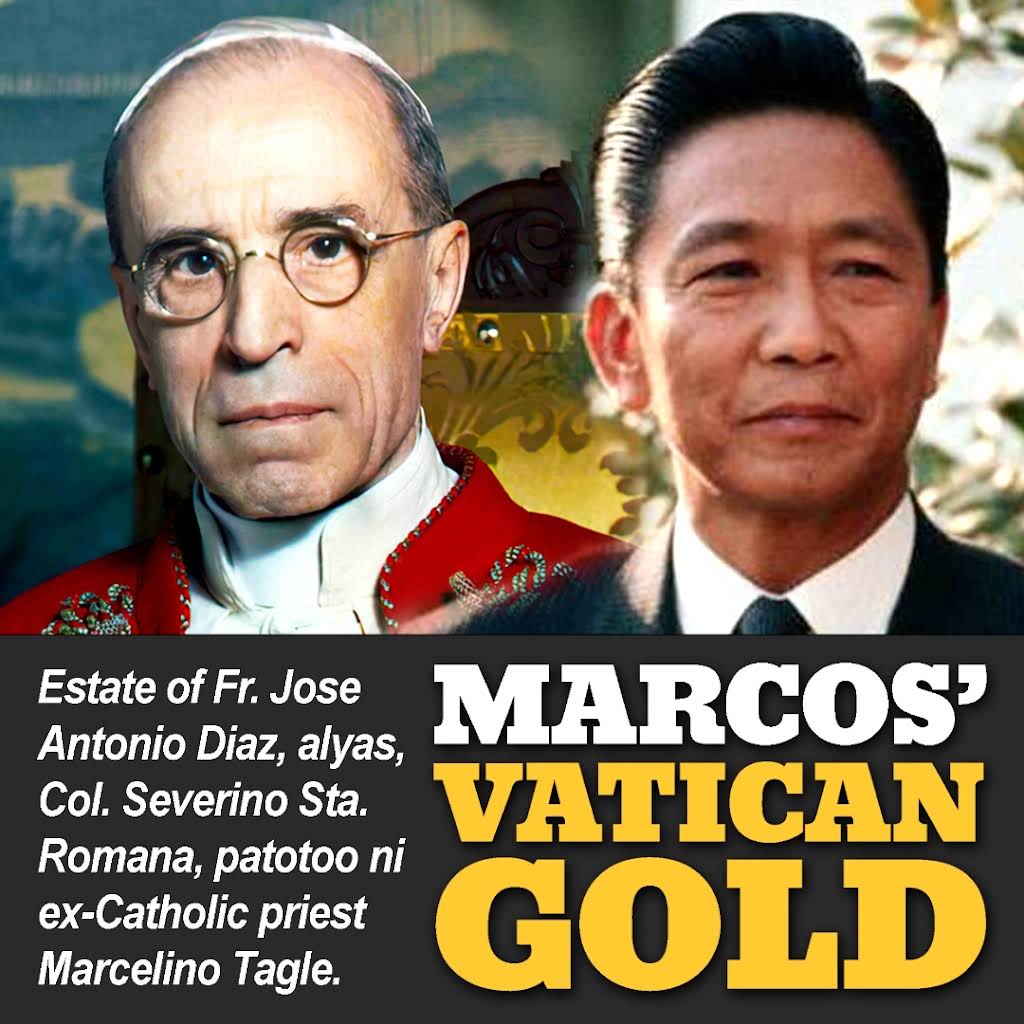

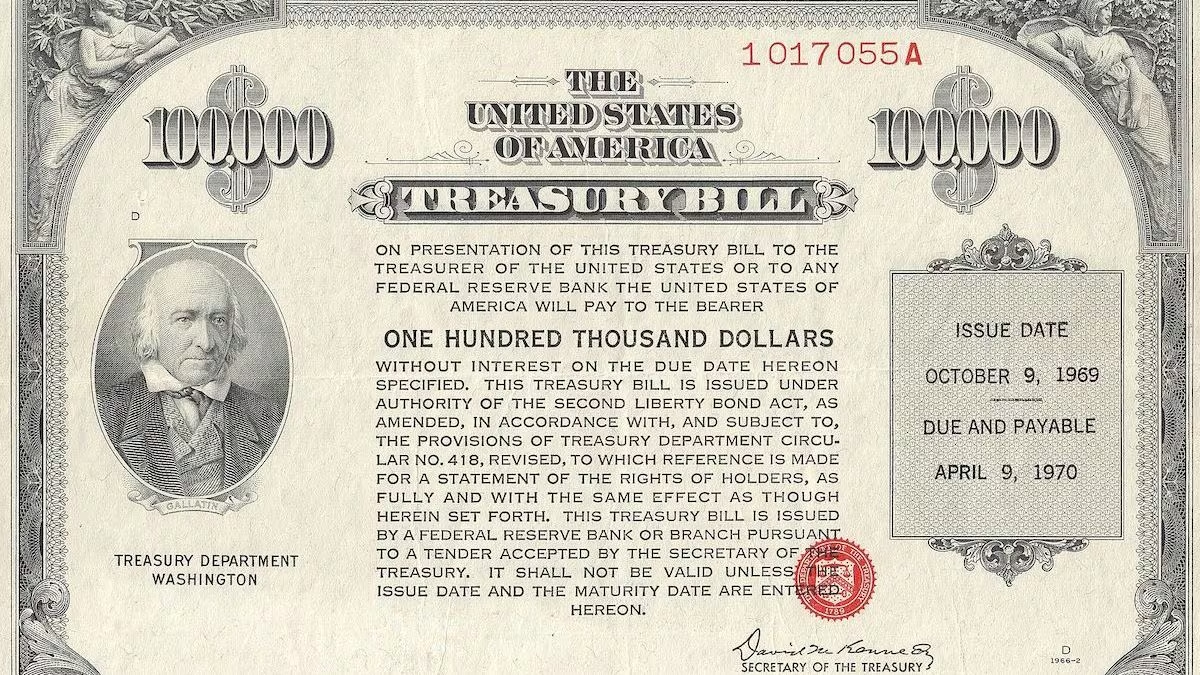

Newpoint received use of Trevor Saliba and Ian Fleming's $42bn treasury bond but pay $0 in interest over 20+ years. Sham?

Forgery

newpoint reinsurance

Trevor Saliba

NMS Special Opportunity Fund LP

NEWPOINT FINANCIAL CORP. (DE, USA)

Keith Beekmeyer

Andy Bye

AM Best Credit rating

PetroVietnam

Financial Conduct Authority

Prudential Regulation Authority

Swiss FINMA

Donald Demery Diaz

Donald Norvell Calhoun

Richard Scott Dvorak

Postd Merchant Banque

Postd Inc

Wells Fargo NA

Wells Fargo non-existent

NPFC SPV 1

PVI Insurance fronting

FINRA USA

FBI

London Stock Exchange

Serious Fraud Office

newpoint surety asset finance ltd

Ian E Fleming NY fraudster

NMS Consulting

US SEC

US Securities and Exchange Commission

Michelle Carter

Sylvia Gois Lennon

Ogier Global Charitable Trustee (Jersey) Limited

Thomas Williamson

NMS Special Opportunity Fund

Newport Capital & Guarantee Ltd

General Professional Indemnity LTD (Bermuda)

Get Cover Limited (UK)

NEWPOINT FINANCIAL CORP. (CA, USA)

Newpoint Lux SV Sarl

NFG Partners Sarl

Novea (WY, USA)

Patrons Group Holdings, Inc. (NV, USA)

Patrons Mutual Fire Insurance Company (NV, USA)

Newpoint is a sham

American Millenium Insurance Company (NJ, USA)

Band And Co., Nominee for U.S. Bank (WI, USA)

Citadel Reinsurance Company LTD (Bermuda)

Mantengu Mining Limited & Langpan Mining Co

NEWPOINT BROKERS LIMITED (UK)

NEWPOINT FUNDING LTD (UK)

Newpoint Reinsurance Company Limited (Nevis)

NPFC SPV 1 Inc (WY, USA)

OSSO ENERGY PLC (UK)

Perfuturo International Insurance, Inc (Guam)

Specialty Management UK LTD (UK)

Starstone National Insurance Company (NJ, USA)

Trailblazers Insurance Company

Spectrum Risk Management and Reinsurance

Mark Smith

Mark Smith

![Woolgar v Newport Capital & Guarantee Ltd | [2024] EWHC 1819(Comm) - Judgment](https://newpoint.markjsmith.com/hubfs/Royal_courts_of_justice.jpg)