Newpoint is a sham: Part 2

The Internet: The Ultimate BS Detector The internet has a long memory, which proves invaluable in an era where financial legitimacy is often shrouded...

2 min read

Mark Smith

:

September 16, 2024 3:15:08 PM AEST

Mark Smith

:

September 16, 2024 3:15:08 PM AEST

No joke.

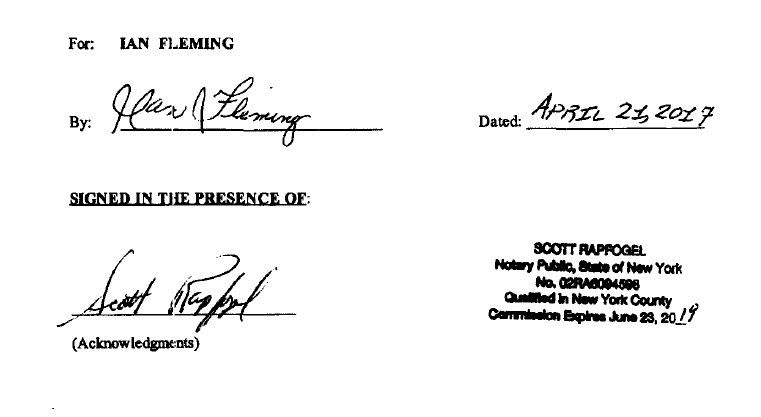

Ian Fleming - discussed in Newpoint is a sham: Part 2 - is not only a "moron ... wacky" according to the NY Post article - but, according to this blogger, is the most generous billionaire I've ever heard of and never met.

Trevor (struck off for life by FINRA and the US SEC) Saliba has provided Newpoint carte blanche use of Ian Fleming's bond (which according to Trevor is legit) - without consideration. Generous. So it seems.

Public documents record:

2077728397 - amending financial statement filed, amending ref 17-758346317. Click here to view filed amending financial statement.

This website has a complete 'fraud map' available to visually review all Newpoint securities.

Click here to register for fraud map - access.

Know more - complete our tip-off form.

What to stay in touch - subscribe for free updates.

Got a story? Complete the form here.

Want more info - chat with our AI smart chatbot, bottom right hand corner.

Regards,

The Internet: The Ultimate BS Detector The internet has a long memory, which proves invaluable in an era where financial legitimacy is often shrouded...

Meet Richard Dvorak - the guy with a registered charge over $500m of Newpoint shares (Rhode Island tax fraudster, the man who would control Newpoint...

Newpoint claims to be backed by Postd Inc.

Let's analyze the investment in a bond that was purchased on February 15, 2013, with a maturity date of February 15, 2043, considering the current...

In the course of investigating one of the dodgiest people I've come across, Steven Papermaster, I stumbled onto some research into probably a lovely...

1 min read

Imagine you have a magic piggy bank that can grow money over time. But, there's a catch: the money you put in today (or in 2013) won't be...

![Woolgar v Newport Capital & Guarantee Ltd | [2024] EWHC 1819(Comm) - Judgment](https://newpoint.markjsmith.com/hubfs/Royal_courts_of_justice.jpg)

England and Wales High Court (Commercial Court): Summary (dated 17 July 2024)