1 min read

Newpoint - What was the value in 2013 of US$42bn payable in 2043?

Imagine you have a magic piggy bank that can grow money over time. But, there's a catch: the money you put in today (or in 2013) won't be...

3 min read

Mark Smith

:

September 9, 2024 4:09:18 PM AEST

Mark Smith

:

September 9, 2024 4:09:18 PM AEST

1 min read

Imagine you have a magic piggy bank that can grow money over time. But, there's a catch: the money you put in today (or in 2013) won't be...

In the course of investigating one of the dodgiest people I've come across, Steven Papermaster, I stumbled onto some research into probably a lovely...

The Internet: The Ultimate BS Detector The internet has a long memory, which proves invaluable in an era where financial legitimacy is often shrouded...

Newpoint claims to be backed by Postd Inc.

Meet Richard Dvorak - the guy with a registered charge over $500m of Newpoint shares (Rhode Island tax fraudster, the man who would control Newpoint...

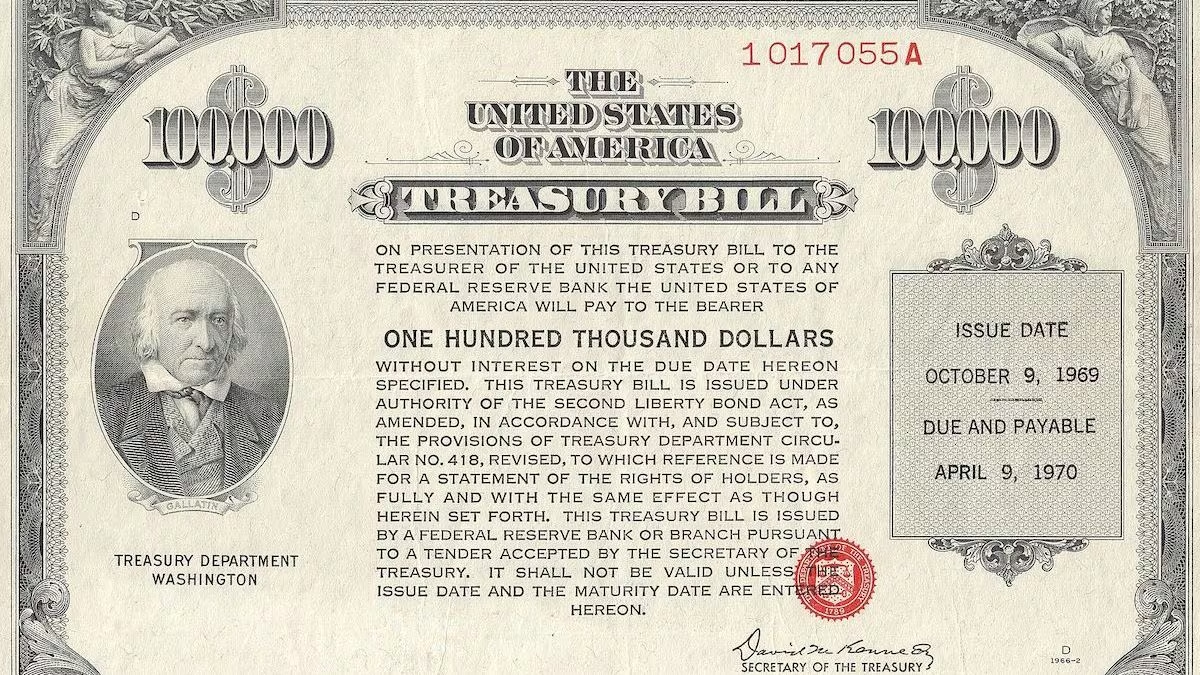

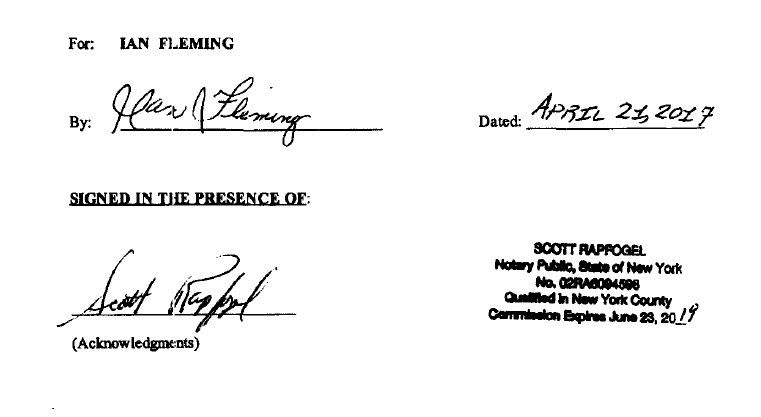

Newpoint received use of Trevor Saliba and Ian Fleming's $42bn treasury bond but pay $0 in interest over 20+ years. Sham?

![Woolgar v Newport Capital & Guarantee Ltd | [2024] EWHC 1819(Comm) - Judgment](https://newpoint.markjsmith.com/hubfs/Royal_courts_of_justice.jpg)

England and Wales High Court (Commercial Court): Summary (dated 17 July 2024)