Newpoint is a sham: Part 3

Meet Richard Dvorak - the guy with a registered charge over $500m of Newpoint shares (Rhode Island tax fraudster, the man who would control Newpoint...

4 min read

Mark Smith

:

September 13, 2024 1:17:30 PM AEST

Mark Smith

:

September 13, 2024 1:17:30 PM AEST

The internet has a long memory, which proves invaluable in an era where financial legitimacy is often shrouded in complex narratives*. This digital memory becomes helpful when figures with a dubious regulatory past, such as those slapped with FINRA or SEC lifetime bans (i.e. Newpoint's Trevor Saliba), take to platforms like the London Stock Exchange (via Newpoint Surety Asset Finance Ltd) to promote securities. In these cases, the internet can serve as a critical tool for unmasking the truth.

Enter Newpoint Surety Asset Finance Ltd., a seemingly reputable, clean-skin firm, part of Newpoint Reinsurance’s network, flaunting a prestigious board and ownership by Ogier Global Charitable Trustee (Jersey) Limited.

But is it as credible as it appears? (We could ask this same question about all of Newpoint?)

And what about the source of the money Newpoint Surety Asset Finance Ltd is supposedly backed by?

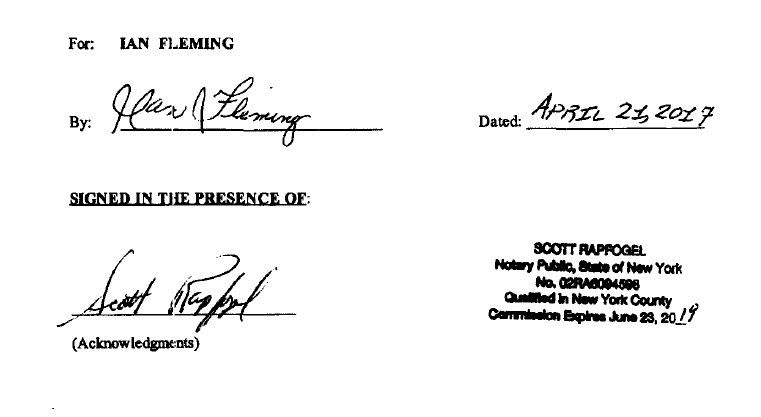

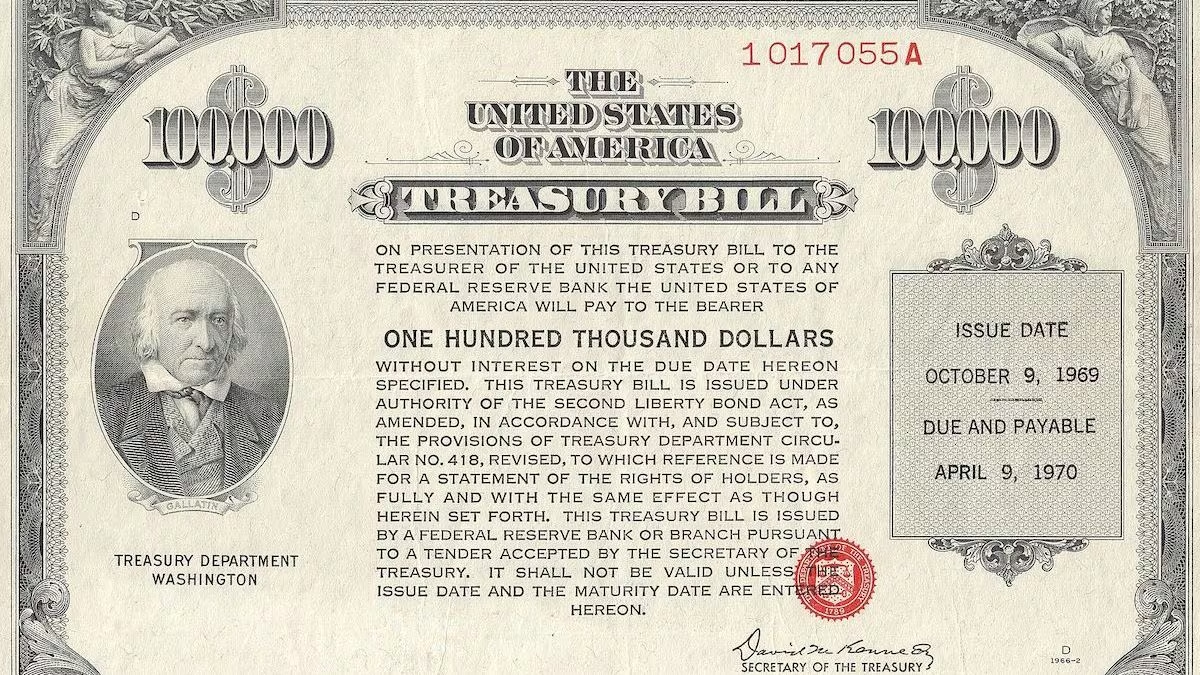

The backing is an ultimately unsearchable US treasury bond (if you believe the documents) owned by mystery man and admitted forger (source: NY Post article), Ian Fleming of humble diggings in East Jamaica, Queens, New York (see below).

- not the mansion I imagined a bloke with $42bn coming his way would own:

- not the mansion I imagined a bloke with $42bn coming his way would own:

... not the mansion I imagined a bloke with $42bn coming his way would own ... 114-39 158th St, Jamaica, NY 11434, USA

With a goal to secure a staggering $1.5 billion to fortify the asset reserves of entities like NFG SARL and NPFC SPV 1, questions arise, skepticism remains.

Are the foundations of Newpoint Surety Asset Finance Ltd financial assertions as robust as they claim, or merely a facade similar to the antics of the infamous Ian Fleming outlined in a revealing New York Post article from his less affluent times?

Newpoint Surety Asset Finance Ltd., an associate of Newpoint Reinsurance seemingly oozes legitimacy and a board composed of impressively credentialed lawyers from Jersey—Thomas Williamson, Michelle Carter, Cheryl Anne Heslop, and alternate director Sylvia Gois Lennon—it certainly paints a picture of reputability.

Owned by the Ogier Global Charitable Trustee (Jersey) Limited, one might wonder what could possibly be questionable about this enterprise?

Could it be that Ian Fleming’s financial prowess is not as solid as portrayed?

Perhaps the truth lies hidden, much like the details found in a revealing article from the New York Post.

BILLION DOLLAR MORON; WACKY $11B ‘DEPOSIT’

But the billion-dollar checks raised suspicions among bank managers.

Fleming was arrested last Thursday and allegedly confessed.

He was charged with attempted grand larceny and faces up to 15 years in prison if convicted.

Efforts to seek comment from Fleming were not successful yesterday.

Source: https://nypost.com/2004/09/19/billion-dollar-moron-wacky-11b-deposit/

The tale of Ian Fleming and his audacious attempt at a multi-billion dollar fraud provides a stark reminder of how easily appearances can be deceiving in the high-stakes world of finance and insurance.

Much like Fleming’s superficially legitimate-seeming exploits, Newpoint Reinsurance has constructed an image of stability and reliability, promising vast asset reserves to back its operations. However, beneath this facade lies a reality marked by dubious affiliations and questionable financial maneuvers. Newpoint Reinsurance - once backed by Demery's / Marcos Gold (still encumbered to Richard Dvorak - Rhode Island's worst tax fraud), is currently completely hocked to Ian Fleming via Trevor Saliba's NMS Special Opportunity Fund.

The involvement of all these individuals with a checkered past in Newpoint’s operations raises significant concerns.

The resemblance to Fleming’s historical antics suggests that Newpoint’s promises may be as hollow as Fleming’s fictional billions?

This is not just a story of one individual’s overreach; it’s indicative of a potentially systemic issue within Newpoint Reinsurance.

The company’s efforts now via the London Stock Exchange to attract significant (legit) capital to replace confetti / monopoly money belonging to Marcos, Dvorak and Ian Fleming begs scruitiny. Its purportedly to bolster its financial base, or is it actually to mirror Fleming’s attempts to fabricate financial stability through grandiose schemes?

The connections extend beyond mere financial sleights of hand to suggest a pattern of behavior within Newpoint Reinsurance. T

he company’s association with figures like Fleming—who have a history of legal and financial improprieties—underscores the risk to investors and stakeholders if they invest even a single cent in Newpoint Surety Asset Finance Ltd - via the London Stock Exchange.

It suggests that the strategies employed at Newpoint may not just be overly ambitious but could potentially border on the fraudulent.

Thus, the relevance to Newpoint lies in the mirrored strategies of creating an illusion of financial prowess where there may be none.

For stakeholders and regulators, this serves as a cautionary tale: the surface often requires a deeper scrutiny to reveal the true foundation—or lack thereof—supporting it.

The past actions of associated individuals are not just footnotes but potentially predictive of the organization’s operational ethos and integrity.

In conclusion, this historical parallel underscores the necessity for rigorous due diligence TODAY (attention AM BEST credit ratings, PVI Insurance and others) and continuous regulatory oversight in the financial and insurance sectors (NB: FBI, Serious Fraud Office and others).

For potential investors and policyholders, it is a reminder that the gloss of legal and financial documents and the charm of company representatives can sometimes conceal rather than reveal the true health of a business.

Know more - complete our tip-off form.

What to stay in touch - subscribe for free updates.

Got a story? Complete the form here.

Want more info - chat with our AI smart chatbot, bottom right hand corner.

Regards,

Mark Smith, 13 September 2024.

Meet Richard Dvorak - the guy with a registered charge over $500m of Newpoint shares (Rhode Island tax fraudster, the man who would control Newpoint...

Newpoint received use of Trevor Saliba and Ian Fleming's $42bn treasury bond but pay $0 in interest over 20+ years. Sham?

Newpoint claims to be backed by Postd Inc.

In the course of investigating one of the dodgiest people I've come across, Steven Papermaster, I stumbled onto some research into probably a lovely...

Let's analyze the investment in a bond that was purchased on February 15, 2013, with a maturity date of February 15, 2043, considering the current...

1 min read

Imagine you have a magic piggy bank that can grow money over time. But, there's a catch: the money you put in today (or in 2013) won't be...

![Woolgar v Newport Capital & Guarantee Ltd | [2024] EWHC 1819(Comm) - Judgment](https://newpoint.markjsmith.com/hubfs/Royal_courts_of_justice.jpg)

England and Wales High Court (Commercial Court): Summary (dated 17 July 2024)