Newpoint is a sham: Part 5 - 200+ securities registered by Newpoint and associates (many not on the balance sheet).

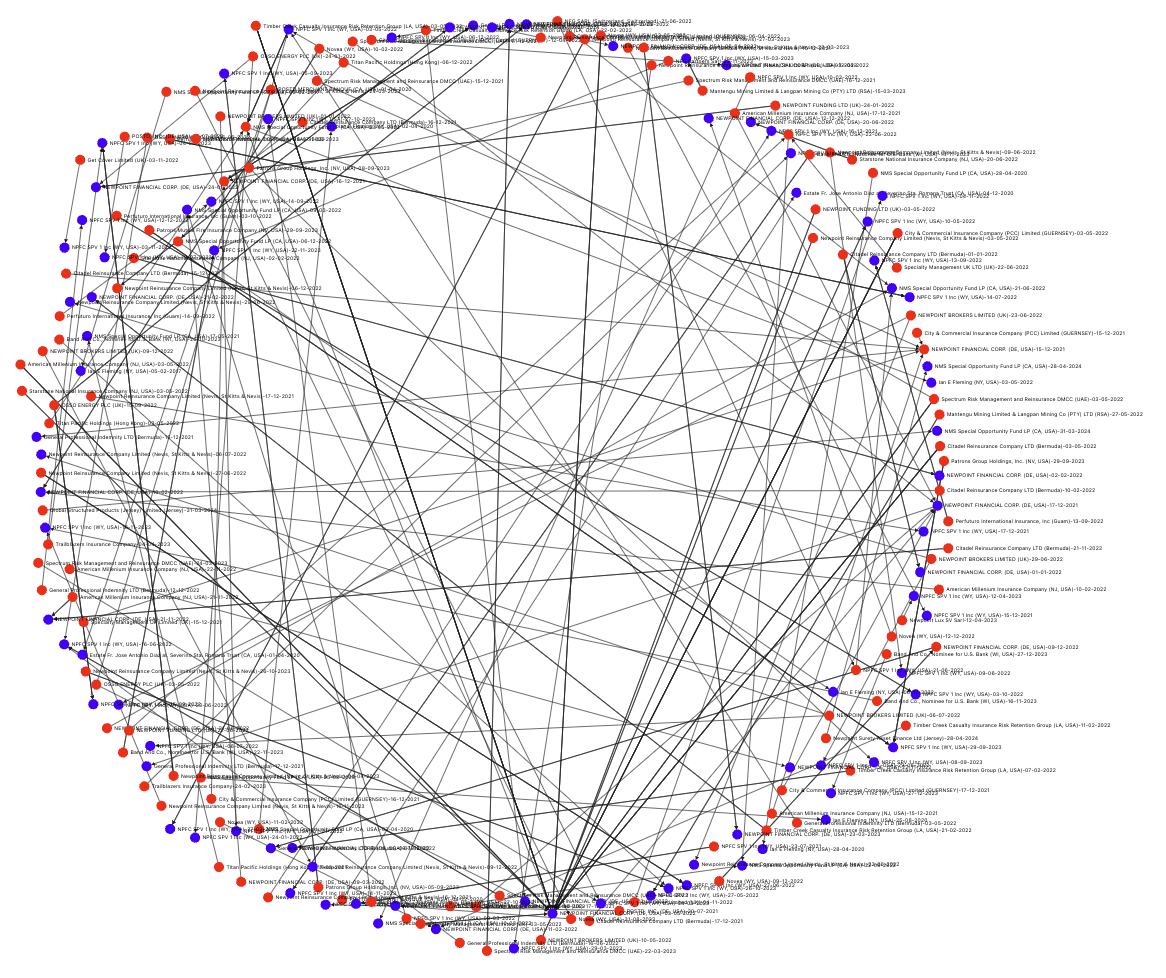

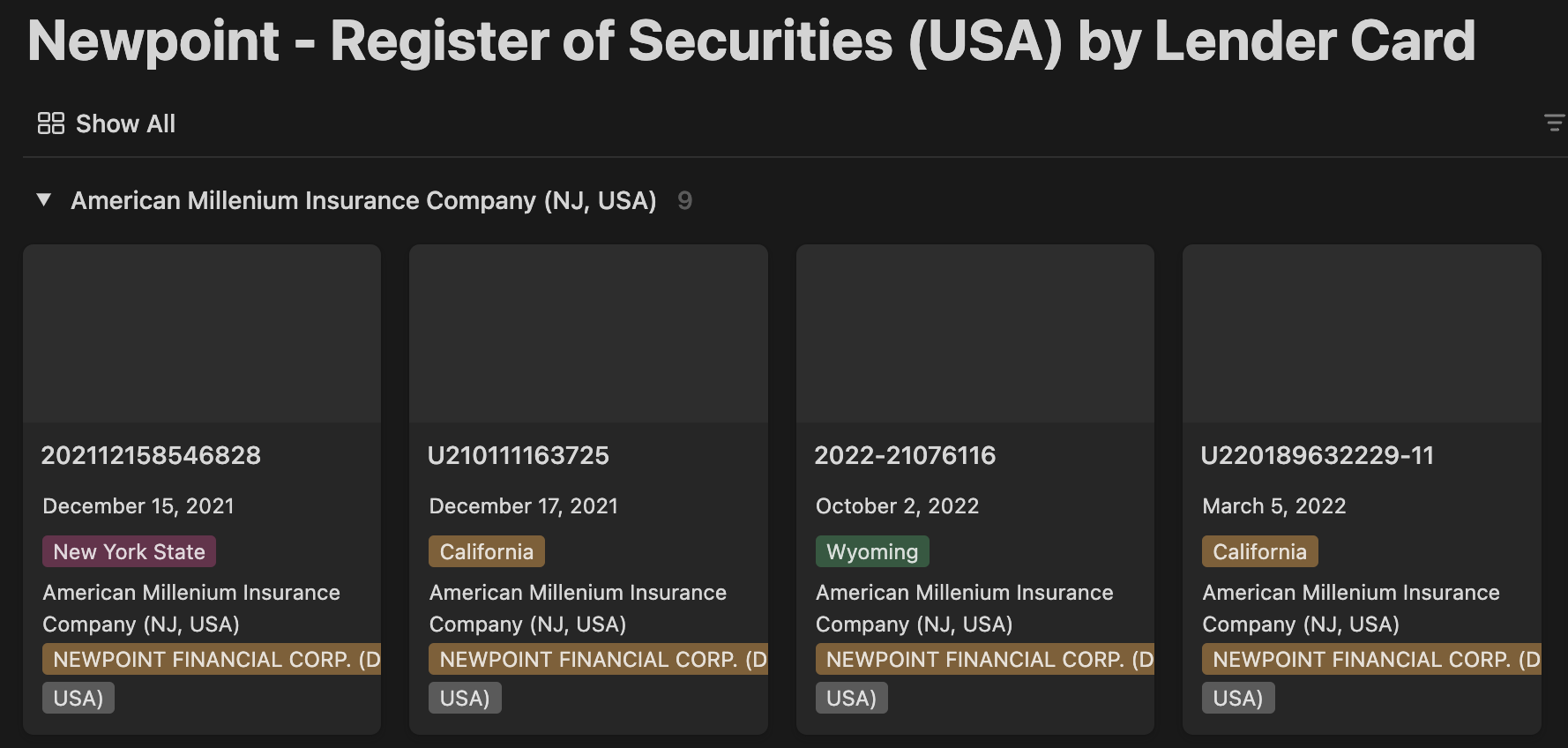

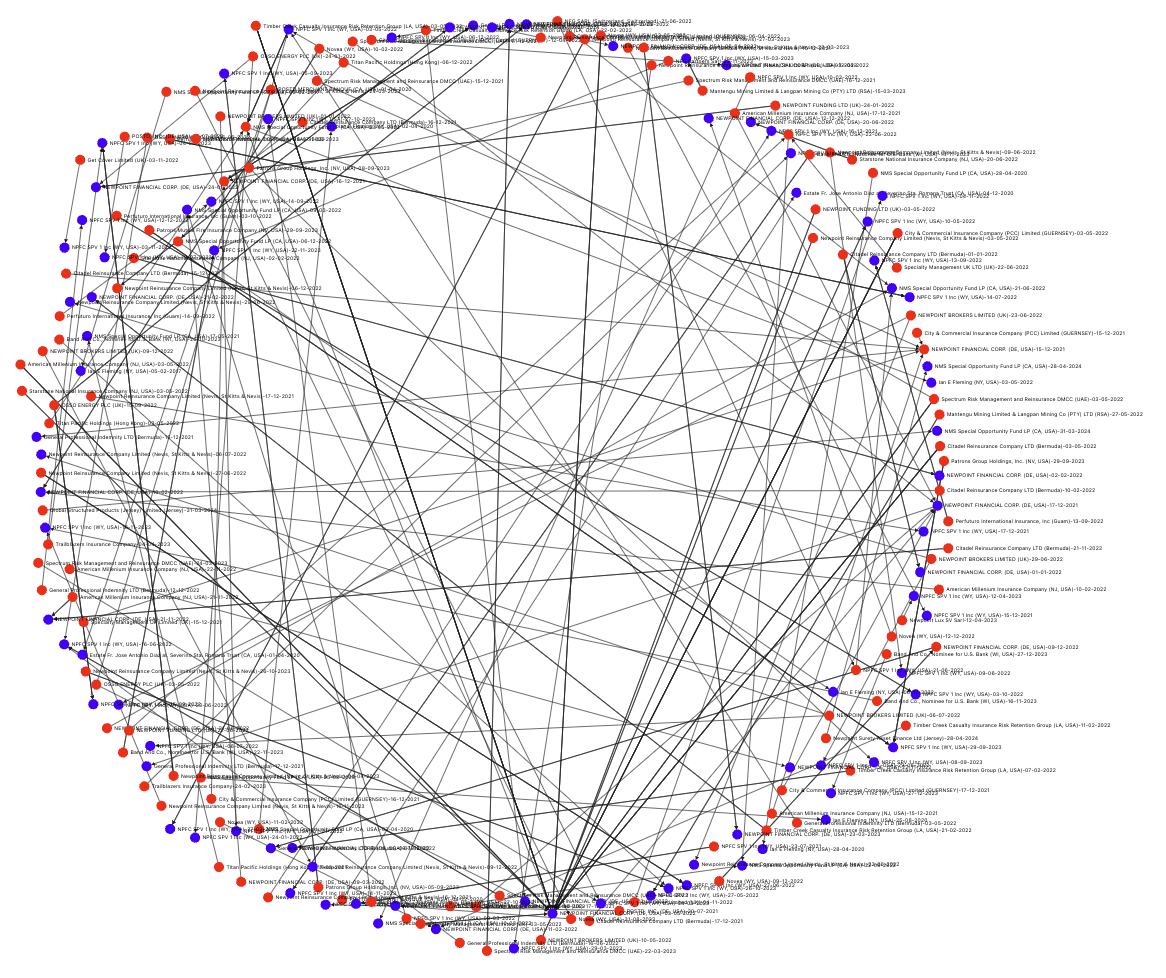

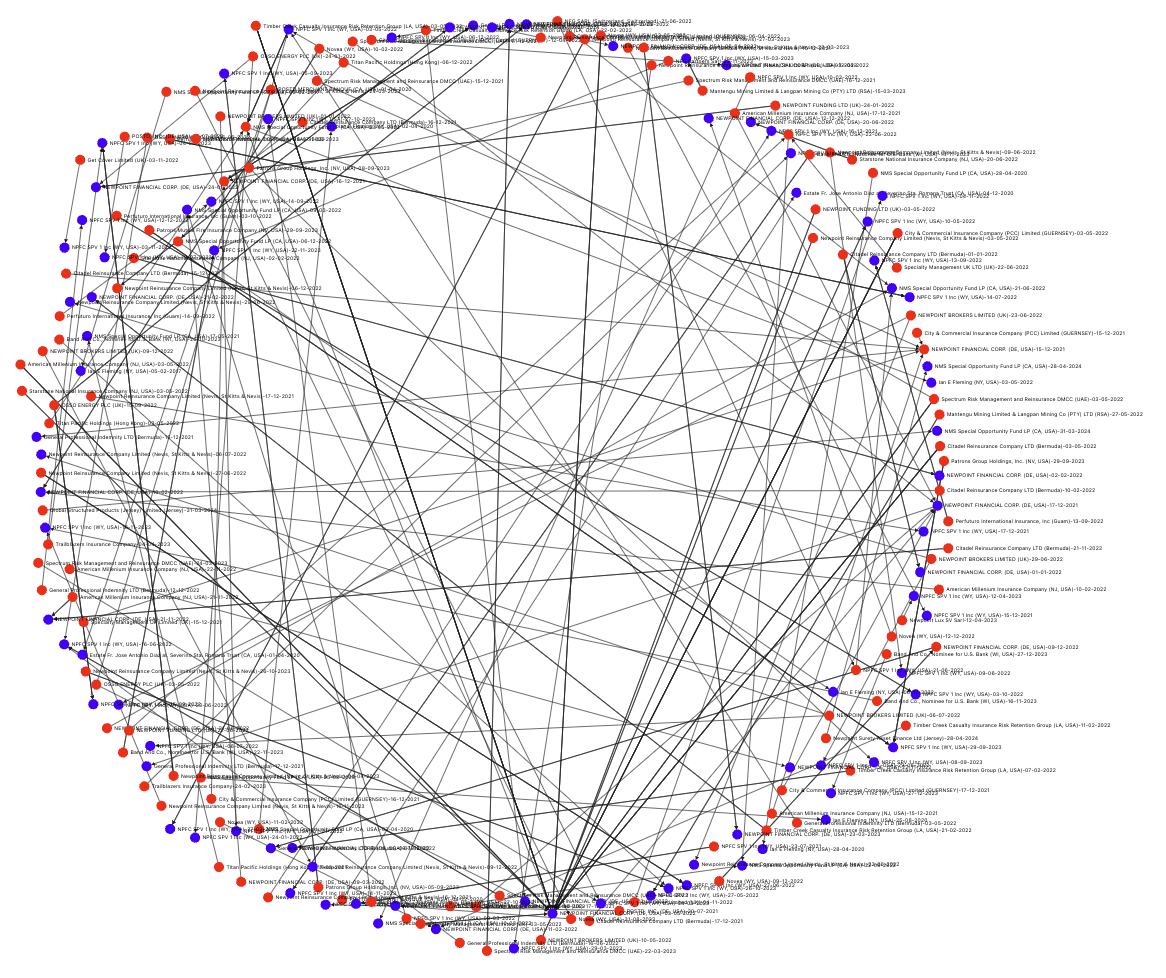

Chronology and schedule of security documents – Newpoint and associated companies and individuals (registrations in the USA) UPDATED

71 min read

Mark Smith

:

September 20, 2024 1:57:08 AM AEST

Mark Smith

:

September 20, 2024 1:57:08 AM AEST

(registrations in the USA)

We apologise for some of the formating and paragraph numbering issues which we will update but have published this in the interests of informing the public and furthering debate.

Further analysis and commentary is expected including factual schedules of misstatements and/or overstatements of asset backing (or otherwise) on the various published balance sheets and financial statements of the associated company.

Securities map to be released shortly.

Know more - complete our tip-off form.

What to stay in touch - subscribe for free updates.

Got a story? Complete the form here.

Want more info - chat with our AI smart chatbot, bottom right hand corner.

Regards,

NPFC SPV 1 - AS SECURED PARTY

(ASSET NOT REGISTERED ON THE NPFC SPV 1 BALANCE SHEET)

NPFC SPV 1 - AS DEBTOR (LIABILITY NOT REGISTERED ON THE NPFC SPV 1 BALANCE SHEET)

Chronology and schedule of security documents – Newpoint and associated companies and individuals (registrations in the USA) UPDATED

Meet Tim Cook and Roy Millender - founders of Newpoint Financial Corp (later renamed NPFC SPV 1, Inc (WY).

AM Best announce Newpoint's credit rating is under review:

Chronology and schedule of NPFC SPV 1 (WY) financial report (sworn on oath) contradicting 80+ security documents – Why are all these 80+ filed...

Ask Mark

2 min read

Summary - Introduction In a recent development, Newpoint Financial Corp., a holding company focusing on investments primarily in regulated...

Chronology and schedule of security documents – Newpoint and associated companies and individuals (registrations in the USA)

Complexity for complexity's sake - the Escher drawing of company designs. Most company structures are straightforward compared to this. With an...

A more simply surface appearance, same inward complexity. click diagram to explore